[Notes compiled by envy##9950]

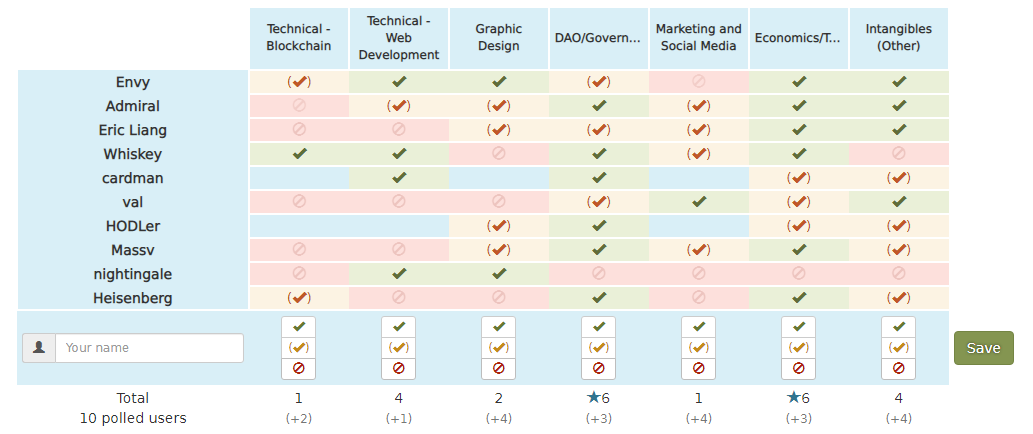

1) Brief intros, expertise or relevant skills #

Education/Industry exposure: Computer science, engineering, biotech, economics, management, political science, financial technology, corporate law, software engineering

Cryptocurrency familiarity: mostly everyone at least a year, as much as six

Locations: Romania, Italy, Western Canada, Eastern USA, Thailand, Spain, Hong Kong

(Screenshot captured 02:04pm UTC, votes not all-inclusive of call audience)

(Screenshot captured 02:04pm UTC, votes not all-inclusive of call audience)

2) Overview of work to date on DAO #

- several ideas were discussed in previous weeks (autocompounding, staking rewards, DEXes) but no concrete work yet

- March 31: NETA NFTs launching on Passage Marketplace, tentative price of 6 ATOM

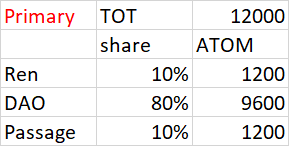

- 80% to DAO, 10% to Rendrasc, 10% to Passage team

- will generate about 12k ATOM, 9.6k ATOM in coffers to start with

- will generate about 12k ATOM, 9.6k ATOM in coffers to start with

- got in touch with dimi, ITA Stakers willing to help as well

- dimi able to help on dev/programming/smart contract side

3) Identify immediate challenges #

- NETA token distribution came before the DAO, now all tokens are outside the DAO, so there’s no centralized community pool, no inflation on token so no incentive to stake

- compared to ION: facing a lot of the same challenges, but they have 75% of the tokens in the DAO (centralized fund)

4) Identify immediate priorities #

How do we generate a treasury? How can we incentivize deposits of NETA into the DAO? How do we accumulate assets to incentivize? #

Possible solutions:

- users that deposit get voting power to guide the direction of the DAO

- vesting schedule of deposited NETA where some amount is returned to users over time

- community-run JUNO validator where profits are forwarded to treasury

- dimi has confirmed that a validator can be run with multisig

- minimum mainnet hardware requirements: https://docs.junonetwork.io/validators/joining-mainnet#recommended-minimum-hardware

- borrowing/lending against NETA

- six week old token, too early for people to have confidence in price range

- Terra started buying BTC for reserves; Nomic BTC bridge to Cosmos coming in Q2 2022

- secondary token airdrop for NETA holders where a percentage is dropped into DAO treasury (discussed 50%)

- drawback: now need to create value for two tokens

- NFT projects, create and sell NFT series where royalties or profits go into treasury

- play off Stargaze launch in current ecosystem

- seek out artists to commission content; NETA community artists making NFTs for Strange Clan

- create NETA content for existing NFT platforms and games

- NETA guild in Strange Clan

- coupon or unlocking feature for holding certain NFTs

- commission the artist for Osmosis, holders would get a gas fee discount. would need to collaborate with core devs and DEX operators for code implementation

- review new CW-20 tokens or give proposal feedback on commonwealth, offer due diligence service for JUNO community

- “stamp of approval” to maintain integrity in JUNO community

- NETA was dropped to JUNO’s most active stakers - people in the NETA community are invested in JUNO’s success

- creates set of governance standards

- potential risk: creates pressure around NETA brand

5) Review NETA purpose/prior agreements/consensus #

- “store of value” agreed upon as brand statement - no reason to change original view

- shotgun approach to creating media for both branding and capturing value for treasury

- capitalize on Roman mythology iconography for art - goddess Juno Moneta

- measure twice, cut once - take a little more time to do it right, work with what we have, no need to overcomplicate